Key to remember:

Connecticut paid sick leave – FAQs to help employers ramp up by January 1

Here are some answers

Come January 1, 2025, many employers with employees working in Connecticut will need to comply with the state’s new paid sick leave. The Connecticut Department of Labor recently released some FAQs about the leave.

Question: Do all employees get to take the leave?

Answer: No. Seasonal employees who work 120 days or less in any year and individuals who are members of construction-related tradesperson employee organizations that are part of a multiemployer health plan are not covered by the law.

Question: Do employers have to do more than put up a poster to inform employees about this leave?

Answer: Yes. Employers must provide written notice to each employee no later than either January 1, 2025, or the employee's first day of employment, whichever is later.

Question: When do employees begin to accrue and take the leave?

Answer: Accrual begins on January 1, 2025, unless the employee was hired after that date. If hired after January 1, 2025, the employee's paid sick time begins to accrue on the employee's first date of employment. Employees may take the leave 120 calendar days after their date of hire.

Question: How does paid sick leave interact with the Connecticut Family and Medical Leave Act (CTFMLA)?

Answer: Typically, if the absence qualifies for both paid sick leave and CTFMLA, then the employer can require an employee to use it while the employee is on CTFMLA. However, the CTFMLA law also allows employees to retain up to two weeks of paid time off if they choose to, so if an employee has less than that the employee can request to keep their paid sick leave.

Question: Can an employee choose to work additional hours or shifts during the same or following time period instead of using paid sick leave?

Answer: Yes, but the employer must agree.

Question: Must employers track hours worked, paid sick leave accrued, and paid sick leave used?

Answer: Yes. Employers must track and keep records of hours worked and paid sick leave accrued and used for every employee as part of their normal record-keeping obligations. This can be done electronically, but only with each employee's consent, and the records must be conveniently, securely, and privately accessible to and printable by the employee.

Question: How should employers calculate employee pay if employees make overtime and/or commissions in addition to their normal hourly wage?

Answer: Overtime and commissions should not be included to determine an employee's normal hourly wage.

Question: Do employees carry over any accrued unused hours into the next year?

Answer: Employees may carry over up to 40 accrued but unused hours into the next year but are not entitled to use more than 40 hours of paid sick leave per year. Instead of carryover, employers may frontload the paid sick leave at the beginning of the new year. Employers may provide options for any time that the employee accrued but did not use during the year to be paid out at the end of the year.

Connecticut employers only have a few weeks left to get up to speed on the state’s new paid sick leave law. These FAQs might help.

This article was written by Darlene M. Clabault, SHRM-CP, PHR, CLMS, of J. J. Keller & Associates, Inc. The content of these news items, in whole or in part, MAY NOT be copied into any other uses without consulting the originator of the content.

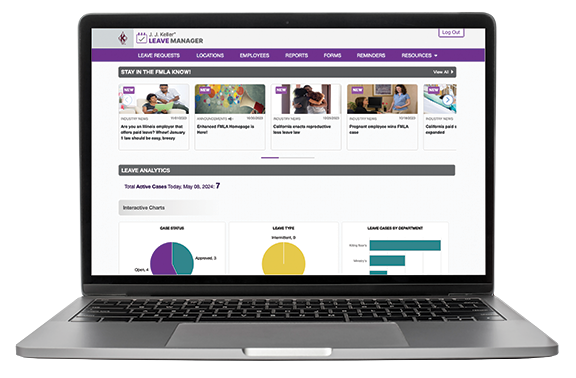

The J. J. Keller LEAVE MANAGER service is your business resource for tracking employee leave and ensuring compliance with the latest Federal and State FMLA and leave requirements.