Key to remember:

Salary threshold increases to $1,059 per week under DOL proposed rule

Change would entitle 3.6 million more employees to overtime

On August 30, the U.S. Department of Labor (DOL) issued a proposed rule that would raise the salary threshold exempt employees must earn from $684 to $1,059 per week; from $35,568 to $55,068 per year.

Employers may classify employees as exempt from receiving overtime pay if those employees meet three criteria:

- They receive a predetermined and fixed salary that isn’t reduced because of variations in the quality or quantity of work performed (the salary basis test);

- The amount of salary paid must meet a minimum specified amount (the salary level test); and

- The employee’s job duties must primarily involve executive, administrative, or professional duties as defined by the regulations (the duties test).

This proposed rule focuses on the second criterion; however, employees must meet all three criteria to qualify for the exemption. The salary increase means that more than 3 million employees would be entitled to receive overtime pay unless their salaries are raised to meet the new threshold.

While many companies have exempt employees already earning a higher salary than this proposal, smaller businesses in certain segments will likely feel a pinch in their profits if this rule is approved. Businesses like restaurants, retail stores, and other service industries that struggle to attract and retain workers while balancing expenses might have to make tough decisions in the coming months.

Highly compensated employees

The rule would also affect highly compensated employees. They are exempt from overtime pay if:

- They earn a certain amount per year;

- Their primary duty includes performing office or non-manual work; and

- They customarily and regularly perform at least one of the exempt duties or responsibilities of an exempt executive, administrative or professional employee.

The threshold for highly compensated employees would also go up from $107,432 to $143,988. Therefore, fewer employees will qualify for this exemption if the rule gets approved.

Past and future

Previously, the DOL tried to increase the salary threshold, but ran up against opposition.

To help reduce future “should we or shouldn’t we” debates on salary increases, the rule also proposes that, after three years, the salary threshold level would update automatically to reflect current earnings data.

Once the rule is published in the Federal Register, there will be links to the proposal and instructions on how to comment on the regulations page. As part of the regulatory process, interested parties (e.g., employers) have 60 days to make comments on the proposed rule.

What’s FMLA got to do with it?

Employers may make deductions from the salaries of exempt employees for intermittent or reduced schedule leave taken under the Family and Medical Leave Act (FMLA).

When an exempt employee takes unpaid FMLA leave, employers may pay a proportionate part of the full salary for time actually worked.

When calculating the amount of a deduction, employers may use the hourly or daily equivalent of the employee’s full weekly salary, or any other amount proportional to the time actually missed.

Employers will need to review whether exempt employees continue to meet the salary threshold requirements under new proposed rule.

This article was written by Darlene M. Clabault, SHRM-CP, PHR, CLMS, of J. J. Keller & Associates, Inc. The content of these news items, in whole or in part, MAY NOT be copied into any other uses without consulting the originator of the content.

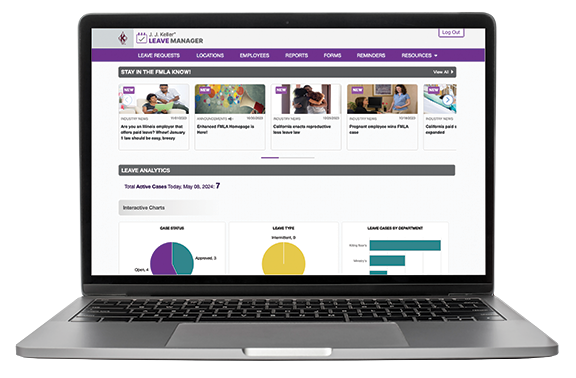

The J. J. Keller LEAVE MANAGER service is your business resource for tracking employee leave and ensuring compliance with the latest Federal and State FMLA and leave requirements.